Join xLab Affiliate Program for Long Term Passive Income: Earn 5% of all revenue generated by your affiliate link via xLab tools, services, or xLab Coin ($5 for every $100). Generate your affiliate link below then share it with as many people as you can.

Generate Your XLab Affiliate Link

in this guide:

1. UNDERSTAND CRYPTO & BLOCKCHAIN TECHNOLOGY

2. IMPORTANCE OF token address

3. GLOSSARY: COMMON CRYPTO TERMS

4. PROs AND CONs OF CRYPTO investment

5. HOW TO BUY NEW CRYPTO TOKEN EARLY TO MAXIMIZE PROFIT

6. How to protect your CRYPTO investment using the security scanner results

7. more to come ...🚀

UNDERSTAND CRYPTO & BLOCKCHAIN TECHNOLOGY

Before we dive into buying and selling Cryptocurrency, let’s start with the most basic question: What is cryptocurrency?

Imagine you have a special kind of digital money. It’s like the paper money in your wallet, except you cannot touch it or hold it in your hand. Instead, it lives on the internet inside a digital vault. That digital vault is called Blockchain and that digital money is called Cryptocurrency, or just Crypto.

Understanding Blockchain Technology

If you are going to buy and sell cryptocurrency which you cannot touch or hold in your hand, you have to know where you will store it after buying it, how to protect it, how to use it or make purchase with it, how to send it to other people for payment, how to move it around, and so on. So, you must understand blockchain network technology before you invest in crypto. Like mentioned above, think of the blockchain as a huge vault with a huge notebook. Everyone in the world can interact with it; and every time someone uses cryptocurrency the notebook automatically writes down what happened. It won’t miss a thing! For example, if you send one crypto coin/token to your friend Joe, the notebook writes “John transfer 1 coin on such and such date…at such and such time…from such and such wallet address…to such and such wallet address is…and every other details.” And nobody can erase or change that note, so it’s super trackable! With that being said, before you can own any cryptocurrency, you have to create a wallet inside that vault we call blockchain. It’s like your regular wallet; so, you have to keep it safe so nobody else can get to it, hence private key and secret recovery key which we will cover in more details further down.

Components and Features of the Blockchain:

- 🪙Coins/Tokens (Cryptocurrency): These are special kinds of digital money store in the blockchain. They’re not made of paper or metal; they are created using Smart Contract. In general, they’re just numbers in the magical vault/notebook called blockchain, but they are as valuable as your allowance money. Some examples are Bitcoin (BTC), Ethereum (ETH), Binance (BNB), Dogecoin (DOGE), Shiba Inu (SHIB), USDT, USDC, Solana (SOL), and a lot more. Some stores and websites let you use these digital money to buy toys, games, or candy! You just transfer it from your wallet to theirs, and the notebook writes it all down automatically. Cool, right?

- 👝Crypto Wallet: As we previously mentioned, Crypto Wallet is where you store your crypto. They also resides in the Blockchain. When you create a wallet, the wallet will give you two things:

a. A public wallet address (this is what you can give other people to send you money). You can also transfer money between multiple wallets using their specific address. We go into details in our upcoming guide for crypto beginners. Be on the look out for it.

b. A Private Key/Secret Recovery Key: This is what you will use to restore your wallet if you change your phone or computer. Keep it safe and do not share it with anyone. Why? Anyone who has access to your private key/secret recovery key can access your wallet and steal your crypto.

Extra Details about Crypto Wallets:

Type of Wallet: There are cold wallets (also known as hardware wallets) and there are hot wallets (aka hot wallets). We go into details in our upcoming guide about both. But what you should know now is that hot wallets are the apps you download and use on your phone without additional hardware. Hot wallets are the most popular. Examples are Trust Wallet and Metamask (these tow are the most widely-used Hot Wallets). The most popular cold wallet is Nano Leger. Also, please note that, although hot wallets are safe if you protect them, cold wallets are safer. You can get one for about $150. Hot wallets are free of charge. Just download the TrustWallet or Metamask app from your appstore/playstore and create a wallet in the app. Reach out if you need further guidance or be on the look out for our upcoming guide for step by step guidance.

3. 📟Smart Contract (also known as Source Code): Everything in the Blockchain is managed by Smart Contracts. In fact, the reason the blockchain is self-managed is because it is governed by Smart Contracts. The Crypto coins/Tokens that resides inside the blockchain is also made of Smart Contract. The wallets are made of Smart Contracts as well. So, what Are Smart Contracts?

- Imagine you and your brother make a deal: “If you clean my room, I’ll give you 2 candies.” Now, instead of your parents making sure you both follow the deal, a smart contract does it for you! And once you sign the deal it cannot be undone. So, you can look at the smart contract like a robot that lives in the magical vault (blockchain). It follows the rules you give it and makes sure everyone sticks to the deal. If you clean the room, the smart contract gives you 2 candies; but if you don’t clean, you won’t receive any candy! The cool thing? Once you set up the robot, it does its job automatically. No arguing, no tricks—it’s fair for everyone.

Real-Life Example of a Smart Contract at Work:

- Let’s say you want to buy a video game online and pay with crypto. The seller of the game sets the price at 50 USDT. You send cryptocurrency to the smart contract via your wallet to pay for the game. The smart contract checks if you send enough coins (USDT). If yes, the smart contract sends the game to you. If no, it gives you your money back or tells you to send the balance. It will not give you the game until it receives what you are supposed to pay. If you send more, it refunds you the balance. The seller of the game is not even aware of what’s going on because the smart contract handles everything. Easy and fair, right!

4. 👮Other Feature of Blockchain Networks: No Boss in Charge:

- With your regular fiat money, there’s a big bank or a grown-up in charge. But with cryptocurrency, it’s different; it’s like a giant group project where everyone has equal access to the vault/blockchain. No one person is the boss!

***Now How Do you Know to Which Blockchain a Token was Deployed?***

To use our token scanner, you have to enter the token address and select the specific blockchain on which that token was deployed. So, how do you find that information? See below:

- Once a token smart contract is deployed on a blockchain, the smart contract/source code is automatically put on the blockchain website so everyone can see it; and the blockchain automatically assign a specific address to the token (we explain in details how to find token address further down below). If the token smart contract is deployed on Ethereum blockchain for instance, everyone can see it on etherscan.io; if it is deployed on Binance Chain (BSC), everyone can see it on bscscan.com and they can see every bit of transactions that smart contract handled. To find out the blockchain to which the token was deployed, the easiest way is to: Copy the token address (we explain how to find the address below) >> go to CoinMarcketCap.com >> paste the token address in the search bar >> Click on the token name >> Look for “Contract” >> Next to the contract you will see the logo or name of the blockchain. For instance, you will see Ethereum (ERC20) or its logo next to token address deployed under the Ethereum blockchain. For token deployed under the Binance blockchain you will see “BNB Smart Chain (BEP20)” or Binance logo. For Solana Blockchain you will see Solana or its logo. Same process for any other blockchain.

***Most Popular Blockchain Networks***

So far, you can see that blockchain networks are the foundations of cryptocurrency. There are many, each has unique features, purposes, and token standards. Below is an overview of the most recognized blockchain networks and their characteristics.

1. Bitcoin (BTC) : https://bitcoin.org/

- Bitcoin is the first and most widely recognized blockchain network, designed primarily as a decentralized digital currency. Its focus is on being a store of value and medium of exchange without intermediaries like banks. Note: Bitcoin does not provide the ability to third parties to deploy token under their blockchain.

- Key Features:

- Uses Proof of Work (PoW) for security and validation.

- Highly secure but slower transaction speeds compared to newer blockchains.

- No smart contract capabilities.

- Primary Use Case: Transferring and storing value.

2. Ethereum (ETH) :Official website is https://ethereum.org; and for token tracking purposes go to https://etherscan.io/

Ethereum is a programmable blockchain that enables the creation of smart contracts and decentralized applications (dApps). It introduced the concept of tokens and decentralized finance (DeFi).

Key Features:

- Supports smart contracts and programmable logic.

- Transitioned to Proof of Stake (PoS) with Ethereum 2.0 for better scalability and energy efficiency.

- Native currency: ETH, used to pay transaction fees (gas). Will discuss gas in more details further down the road.

- Primary Use Case: A foundation for DeFi, NFTs, dApps, and more.

- ERC20 Token: Token created under the Ethereum Blockchain are called ERC20 Token. ERC20 is a technical standard for creating fungible tokens on the Ethereum blockchain.

- Used for creating cryptocurrencies, governance tokens, and utility tokens.

Examples of Ethereum/ERC20 Token:

- Shiba Inu (SHIB)

- USDT (Tether): A stablecoin pegged to the USD. By that we mean USDT’s value does not increase or decrease. 1 USDT is usually equivalent to 1 U.S. Dollar and it always remains the same no matter how volatile the crypto market is. Swapping any token for USDT is like selling the token for U.S. Dollar. It’s important to note that USDT has its own blockchain named TRON” and it also operates under multiple other blockchains including Binance LINK (Chainlink): A decentralized oracle network token.

3. Binance Smart Chain (BSC): For Token Tracking Purposes: https://bscscan.com/; Organization website: https://www.bnbchain.org; Binance Crypto exchange: https://www.binance.com/; Binance Crypto Exchange For USA Resident: https://www.binance.us

Binance Smart Chain (BSC) is a blockchain network created by Binance, designed for running smart contracts and dApps. It’s faster and more affordable compared to Ethereum.

Key Features:

- Operates on Proof of Staked Authority (PoSA) consensus mechanism.

- Compatible with Ethereum’s ecosystem and supports the same tools (e.g., MetaMask).

- Lower transaction fees compared to Ethereum.

- Primary Use Case: DeFi applications, token swaps, and gaming platforms.

- BEP20 Token: BEP20 is the token standard for creating fungible tokens on BSC, similar to Ethereum’s ERC20 standard.

- Designed for speed and low fees.

- Compatible with Ethereum’s ERC20 standard, making it easy for developers to migrate dApps.

Examples:

- CAKE (PancakeSwap): A token for the PancakeSwap decentralized exchange (Will provide more details about PancakeSwap further down)

- BUSD: Binance’s stablecoin pegged to the USD.

4. Solana (SOL) : For Token Tracking and Information: https://solscan.io; Organization website: https://solana.com/

Solana is a high-performance blockchain network focused on scalability and speed. It’s designed to handle thousands of transactions per second at low costs, making it ideal for DeFi and NFTs.

Key Features:

- Uses a unique Proof of History (PoH) consensus mechanism combined with Proof of Stake (PoS).

- Extremely low transaction fees.

- Known for its speed, capable of processing over 50,000 transactions per second.

- Primary Use Case: High-speed DeFi applications, gaming platforms, and NFT marketplaces.

Token Standard:

- Solana does not have a specific standard like ERC20 or BEP20, but developers can create custom tokens using Solana’s development tools (e.g., SPL tokens).

Examples:

- USDC (on Solana): A stablecoin that uses Solana’s speed for quick transfers.

- USDT on Solana.

- STEPN (GMT): A token used in the Solana-based fitness app.

So, you can see that each of these networks plays a vital role in the cryptocurrency ecosystem, catering to different use cases, from simple payments (Bitcoin) to complex decentralized applications (Ethereum, BSC, and Solana). Learn more about blockchains in our upcoming crypto guide. Don’t miss it. Join our Social Media channels or visit our website often.

HOW AND WHERE TO FIND TOKEN ADDRESS

💎Token Address and its Importance:

We mentioned above that, when someone creates a token, the blockchain automatically assign an address to that token (we explain how that works in more details in the upcoming guide). For instance, Shiba Inu (SHIB) Token was created under the Ethereum Blockchain, the blockchain automatically assigned the following address to SHIB: 0x95ad61b0a150d79219dcf64e1e6cc01f0b64c4ce. That address is called Token Address and it is unique to SHIB. Think of the contract address as a Social Security Number or Drivers License number. Once someone enter those numbers in a database, your name and all information about you will come up. There can be many copy cats trying to deceive you into buying their fake token while you think you’re buying SHIB. But if you have the real SHIB’s contract address you will not fall for their trick. That is why token address is very important when you are investing in new crypto.

In general, a token address is a unique identifier for a specific cryptocurrency token on a blockchain. You can also think of it as the “home address” where that token lives on the blockchain. If someone wants to interact with or send a specific token to pay someone else, they need this address to identify it.

Any interaction with the token—sending, receiving, or trading—requires the token address. Wallets, exchanges, and decentralized applications (dApps) use this address to interact with the token’s smart contract. Additionally, the token address allows anyone to view all transactions related to that token on the blockchain. It provides a way to verify token supply, ownership, and transaction history. Moreover, when adding a new token to a wallet, you often need to input the token address manually. This tells the wallet how to track and display your balance for that specific token. Finally, the token address helps to define the token’s behavior, such as, Total supply maximum supply, circulating supply, how tokens are transferred, who owns what, and so on.

We cannot stress the following enough: When you are buying a token, the first thing you have to look for is its contract address so to make sure you buy the genuine token and not a copy cat.

💎How and Where to Find Token Address:

Below are some of the trusted locations where you can find a token address:

- 🔒Official Sources

The safest way to find a token address is through its official channels:

- Official Website: Visit the token’s official website. Reputable projects will often display their token address under a section like “Contract Address” or “Token Details.”

- Social Media & Announcements: Check the project’s official Twitter, Telegram, or Discord for updates or pinned messages containing the token address.

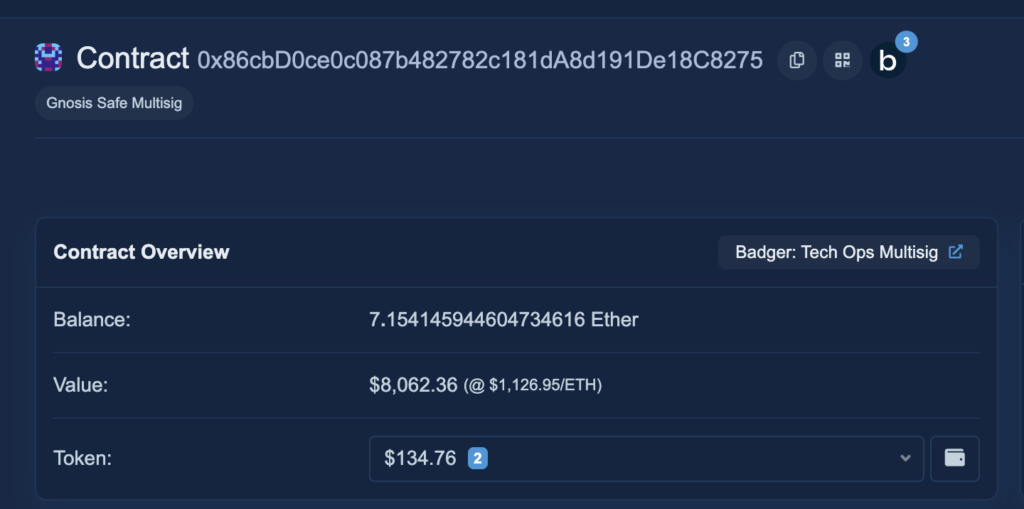

- 🔒Blockchain Explorers: Blockchain explorers allow you to search for and verify token addresses on the blockchain.

For Ethereum (ERC-20 tokens): Use Etherscan: https://etherscan.io/

Use the search bar to type the token name (e.g., “USDT” or “Tether”). Find the verified token in the results and click on it. The token address will appear under Profile Summary, labeled as Contract Address.

For Binance Smart Chain (BEP-20 tokens): Use BscScan: https://bscscan.com/

- Follow the same process as above.

For Other Blockchains:

- Polygon: Use Polygonscan (polygonscan.com).

- Avalanche: Use Snowtrace (snowtrace.io).

3. 🔒Wallets & Exchanges

If the token is listed on a reputable wallet or exchange, you can often find its token address there. When viewing the token’s page on platforms like Binance or Coinbase, you can find information, including the token address. Always confirm with blockchain explorers. We will provide more details about crypto exchanges in the upcoming guide.

- 🔒Token Aggregators & Listings

- CoinMarketCap (CMC): The most widely-used source of information by all crypto enthusiasts. It’s a very reliable source to find token address. But be aware of multiple tokens with the same name (copy cats) and be sure you check and doublecheck to make sure the token address you get is for the exact token you intend to buy.

- Visit coinmarketcap.com.

- Search for the token by name.

- Scroll down to the “Contracts” section to find the token address (if you are on the web version) or go to the “About” tab and select “Contract” (if you are using the mobile app).

- Always verify the address against multiple sources including the project’s website or social media.

- CoinGecko: Similar to CMC, CoinGecko lists token addresses under the “Info” section. https://www.coingecko.com/

Tips to Ensure Safety while Looking for Token Addresses:

- Compare the address on multiple sources. Again, fake tokens often use similar names to confuse users.

- Avoid Copying from Unknown Sources: Never trust random websites, messages, or forums for token addresses.

- Use Verified Tokens: Look for a checkmark or verified badge on blockchain explorers like Etherscan or CoinMarketCap.

We are available to answer your questions. Contact us or reach out to us via social media (Telegram or Twitter).

GLOSSARY: COMMON CRYPTO TERMS

A

- Altcoin: Any cryptocurrency other than Bitcoin (e.g., Ethereum, Litecoin, Solana).

- ATH (All-Time High): The highest price a cryptocurrency has ever reached.

- ATL (All-Time Low): The lowest price a cryptocurrency has ever reached.

- Airdrop: The distribution of free cryptocurrency tokens to wallet holders, often for promotional purposes.

- Arbitrage: Taking advantage of price differences for the same asset across different exchanges to make a profit.

B

- Bear Market: A market condition where prices are declining over a prolonged period.

- BEP-20: A technical standard for fungible tokens on the Binance blockchain.

- Blockchain: A decentralized, digital ledger that records transactions in a secure, transparent, and immutable manner.

- Bull Market: A market condition where prices are increasing over a prolonged period.

- Burn: The process of permanently removing a cryptocurrency from circulation to reduce supply.

C

- Cold Wallet: An offline cryptocurrency wallet, often used for secure, long-term storage.

- Consensus Mechanism: The method by which a blockchain validates transactions (e.g., Proof of Work, Proof of Stake).

- Cryptography: The practice of securing information using encryption, forming the backbone of blockchain technology.

- Circulating Supply: The total number of coins or tokens currently available in the market.

D

- DeFi (Decentralized Finance): Financial services (e.g., lending, borrowing) built on blockchain technology without intermediaries.

- DEX (Decentralized Exchange): A platform for peer-to-peer cryptocurrency trading without a central authority.

- DAO (Decentralized Autonomous Organization): A self-governing organization where decisions are made collectively by token holders.

- Doxxing: Revealing the identity of an anonymous developer or individual in the crypto space, often controversial.

E

- ERC-20: A technical standard for fungible tokens on the Ethereum blockchain.

- ERC-721: A technical standard for non-fungible tokens (NFTs) on the Ethereum blockchain.

- Exchange: A platform where cryptocurrencies can be bought, sold, or traded.

F

- Fiat: Government-issued currency, such as USD, EUR, or JPY, not backed by a physical commodity like gold.

- FOMO (Fear of Missing Out): The anxiety of missing an investment opportunity, leading to impulsive buying.

- Fork: A change in a blockchain protocol that can create two versions of the blockchain (e.g., Bitcoin and Bitcoin Cash).

- Front Running: When a trader exploits knowledge of pending transactions to make trades for personal gain.

H

- Halving: A scheduled reduction in the mining rewards for cryptocurrencies like Bitcoin, which occurs every four years.

- HODL: A term originating from a typo of “hold,” meaning to keep and not sell cryptocurrency, regardless of price movements.

- Honeypot: A scam where smart contracts are designed to let users buy tokens but prevent them from selling, trapping funds.

I

- ICO (Initial Coin Offering): A fundraising method in which new cryptocurrencies sell their tokens to early investors.

- IEO (Initial Exchange Offering): A fundraising event conducted directly on a cryptocurrency exchange, ensuring legitimacy and accessibility.

- IDO (Initial DEX Offering): A token sale that occurs on a decentralized exchange (DEX), providing immediate liquidity and access.

L

- Liquidity: The ease with which an asset can be converted into cash or another asset without significantly affecting its price.

- Layer 2: A secondary framework or protocol built on top of a blockchain to improve scalability and reduce transaction fees.

- Limit Order: An order to buy or sell a cryptocurrency at a specific price or better.

M

- Market Cap: The total value of a cryptocurrency, calculated as price × circulating supply.

- Mining: The process of validating blockchain transactions and earning new cryptocurrency as a reward.

- Moon: A term used to describe a cryptocurrency’s price rising significantly.

- Market Maker: An entity or individual providing liquidity to a trading pair by placing buy and sell orders.

N

- NFT (Non-Fungible Token): A unique digital asset representing ownership of items like art, music, or collectibles on a blockchain.

- Node: A computer that participates in a blockchain network by storing and validating transaction data.

P

- Peer-to-Peer (P2P): Direct transactions between users without intermediaries.

- Private Key: A secure code that allows access to and management of a cryptocurrency wallet.

- Proof of Work (PoW): A consensus mechanism requiring miners to solve complex puzzles to validate transactions.

- Proof of Stake (PoS): A consensus mechanism where validators are chosen based on the number of tokens they “stake.”

- Pump and Dump: A manipulative scheme where the price of a cryptocurrency is artificially inflated (pumped) and then quickly sold off (dumped).

R

- Rug Pull: A type of scam where developers abandon a project and run off with investors’ funds.

- ROI (Return on Investment): A measure of the profitability of an investment.

- Roadmap: A project’s planned timeline for development and milestones.

S

- Satoshi: The smallest unit of Bitcoin, equal to 0.00000001 BTC.

- Smart Contract: Self-executing contracts with terms written directly into code, running on blockchains like Ethereum.

- Stablecoin: A cryptocurrency pegged to a stable asset like fiat currency (e.g., USDT, USDC).

- Staking: The process of locking up cryptocurrency to support blockchain operations in exchange for rewards.

- Scam Coin: A cryptocurrency created with fraudulent intent, often promising unrealistic returns.

T

- Tokenomics: The study of a cryptocurrency’s economic structure, including supply, distribution, and utility.

- Trading Pair: A pair of cryptocurrencies that can be traded for one another (e.g., BTC/ETH).

- Trustless: A system where participants do not need to trust each other or a third party, as the blockchain ensures security.

W

- Wallet: A tool for storing and managing cryptocurrency (can be hot or cold).

- Whale: An individual or entity holding a large amount of cryptocurrency, capable of influencing the market.

- Whitepaper: A document outlining the details and technical aspects of a cryptocurrency or blockchain project.

Y

- Yield Farming: Earning rewards by providing liquidity or staking assets in DeFi protocols.

PROs AND CONs OF INVESTING IN CRYPTO: WHAT TO KNOW

The following are some of the pro and cons of investing Cryptocurrency:

1. Extreme Volatility

- Expansion: Cryptocurrency prices can fluctuate by double-digit percentages within hours, driven by factors like market sentiment, news, or whale activity (large holders moving coins). For instance, Bitcoin has seen price swings of over 10% in a single day.

- Mitigation Strategies:

- Use stop-loss orders to automatically sell at a predetermined price to minimize losses.

- Avoid over-leveraging in trades. High leverage can amplify losses in volatile markets.

- Diversify your portfolio to spread risk across multiple assets.

2. Lack of Regulation

- Expansion: The absence of clear and consistent regulations globally makes the crypto market vulnerable to scams, fraudulent projects, and sudden legal crackdowns (e.g., exchange shutdowns).

- Mitigation Strategies:

- Only trade on reputable exchanges with a proven track record, such as Binance, Coinbase, or Kraken.

- Conduct due diligence on projects, verifying team credibility, partnerships, and whitepapers.

- Keep funds in non-custodial wallets (like hardware wallets) to maintain control.

3. High Risk of Loss

- Expansion: Many traders enter the crypto market without proper education, relying on hype or emotions, leading to costly mistakes.

- Mitigation Strategies:

- Start with a demo trading account to practice without risking real money.

- Educate yourself on trading strategies, technical analysis, and market psychology.

- Only invest money you can afford to lose, adhering to the rule: “Don’t trade with emotions.”

4. Complexity

- Expansion: The crypto ecosystem involves technical concepts like wallets, blockchain, private keys, and DeFi, which can confuse newcomers.

- Mitigation Strategies:

- Start with simple platforms (e.g., Coinbase) before moving to advanced trading platforms.

- Follow tutorials or guides, and engage in communities like Reddit or Telegram for peer learning.

- Use user-friendly wallets like Exodus or Trust Wallet for easy storage and transactions.

5. Security Risks

- Expansion: Hacks are a common issue, with exchanges like Mt. Gox and FTX losing millions of dollars to breaches or mismanagement.

- Mitigation Strategies:

- Use hardware wallets (e.g., Ledger, Trezor) for cold storage, keeping private keys offline.

- Enable 2FA (Two-Factor Authentication) on all exchange accounts.

- Avoid phishing scams by double-checking URLs and using only official websites.

6. Tax Complications

- Expansion: Taxation on crypto differs by jurisdiction, often involving capital gains, staking rewards, and airdrops. Non-compliance can result in penalties.

- Mitigation Strategies:

- Use crypto tax tools like Koinly, TokenTax, or CoinTracker to track transactions and calculate taxes.

- Keep detailed records of all trades, including dates, amounts, and exchange fees.

- Stay updated on your local crypto tax regulations to avoid surprises.

7. Emotional Trading

- Expansion: Fear of missing out (FOMO) or fear of loss (FUD) often drives traders to make impulsive decisions, resulting in losses.

- Mitigation Strategies:

- Create a trading plan with clear entry and exit points.

- Use a risk-reward ratio (e.g., 1:2 or 1:3) to determine whether a trade is worth taking.

- Take breaks from trading when emotions run high to avoid revenge trading.

8. Environmental Concerns

- Expansion: Cryptos like Bitcoin use energy-intensive mining processes, sparking debates over their environmental impact.

- Mitigation Strategies:

- Support eco-friendly cryptocurrencies that use Proof-of-Stake (PoS), such as Ethereum, Cardano, or Solana.

- Educate others about the environmental differences between Proof-of-Work (PoW) and PoS mechanisms.

Additional Risk Mitigation Strategies

Follow News Carefully:

- Track developments in regulation, major partnerships, and global events that may impact the market. Use tools like Crypto ToolBox Lab, CoinTelegraph or CryptoPanic.

Use Dollar-Cost Averaging (DCA):

- Instead of investing a lump sum, spread investments over time to reduce exposure to price volatility.

Join Communities:

- Engage with communities on Twitter/X, Discord, Reddit, or Telegram to gain insights and learn from experienced traders.

Backup and Recovery:

- Store private keys securely and have a recovery plan for wallets in case of device loss.

HOW TO BUY NEW CRYPTO TOKEN EARLY TO MAXIMIZE PROFIT

In cryptocurrency investment, 3 minutes can be the difference between making $100 profit and making $1000000 profit on your investment. Keep these two things in mind as we move forward: 1. Price of merchandizes always increases as demand increases. 2. The key to make profit in any investment is to buy low and sell high. For Crypto, that also means buy early before more people get in; then sell when the price goes up as more people are buying the token. The one and only way to buy crypto tokens early is to buy on Decentralized Exchanges (DEX). For example, let’s say you decide to invest $500 in the XLab Coin today on a DEX before it is listed on every big exchange where more people have access to buy it. Let’s say XLab’s current price is $0.0007 per coin. So, you will receive approximately 714,286 XLab coins. Then let’s say you hold XLab Coin in your wallet waiting for opportunities. A week later you look up and see that XLab coin is being traded at $0.007 per coin because it is listed on a Centralized exchanges (CEX) where more people now access to buy the coin, and more people are buying it. That means you will turn $500 into $5000 in one week. Here is another example: An investor bought $1000 worth of SHIB token in 2020, then watched his money going up and down but did not sell. Between January and November 2021, SHIB’s price increased by about 14467432% as more and more centralized exchanges are listing the token, making it widely available for purchase. As a result, that investor turned $1000 into over 145 Million dollars in about a year. That is the importance of knowing how to buy Crypto token on Decentralized Exchange (DEX) before they get listed on big Centralized Exchanges (CEX).

Click HERE to read the full article about how to buy and sell token in DEX.

Credits:

By Jerome J:

Cybersecurity Engineer & Electronics Engineer: Specialized in Blockchain Technology, Smart Contract Development, Web Development, and so on. Use our services by visiting:

Website: https://cryptotoolkits.com/

Website: https://bbspectrum.com/

Twitter/X: https://x.com/cryptotoollab